2023 Growth Benchmarks for Private SaaS Companies

October 26, 2023

Benchmarking your SaaS company's performance against public SaaS firms may seem straightforward, but it has its limitations. The vast size disparity between public corporations and smaller, privately held ones can lead to misleading or distracting comparisons.

To address this information gap, we initiated our annual survey a decade ago, aiming to assist small, private companies in gaining better insights into how they fare compared to their peers. Our survey places emphasis on tracking key SaaS metrics, one of which is revenue growth. Along with profitability and retention, your company's growth rate significantly influences its valuation multiple. Furthermore, how you stack up against similar-sized and staged companies determines whether you might receive a valuation premium or discount relative to your peer group's median valuation.

Private SaaS Growth Rates by Company Size

A comparison of how fast your SaaS business is growing versus others’ growth rate is only relevant when you are comparing similarly sized businesses. A growth rate of 30% for a $5 million SaaS business is below the median, while growth of 30% for a $20 million SaaS business is above the median. Despite identical growth rates, the smaller company might be worth 3 times revenue (as a relative laggard), while the larger might be worth closer to 10 times revenue (as a champion among its peers).

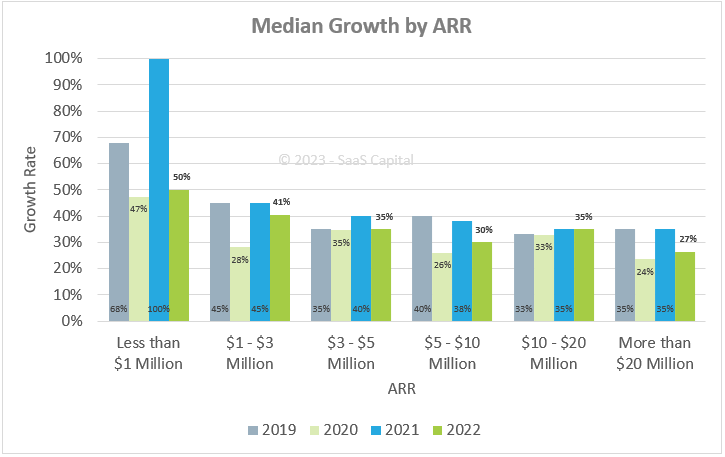

The chart below shows median year-over-year (YoY) growth broken down by Annual Recurring Revenue (ARR) for 2019, 2020, 2021, and 2022.

What is a Good Growth Rate for a SaaS Company?

The overall median growth rate for all companies in the survey registered 35%. This is down from an overall median of 40% in 2021 and puts growth closer to the pandemic levels seen in 2020. Figure 1 shows median year-over-year (YoY) growth broken down by Annual Recurring Revenue (ARR) for 2019, 2020, 2021, and 2022. The data corroborates what we’ve seen and heard in the market. Over the last year, as public company valuations cratered from a median of nearly 17x current run rate ARR, to 6.0x ARR, the private capital markets similarly cooled. With the funding spigot shut, SaaS companies have had to make a shift from growth toward profitability. That, combined with ongoing concerns about a looming recession and anecdotal stories of longer sales cycles, sets the stage for slower growth.

However, it is worth noting that while growth slowed, the overwhelming majority of respondents still posted positive growth. Overall, only 3.1% of the companies reported flat or negative growth in 2022. That is only marginally higher than the 2.7% of the companies that reported flat or negative growth in 2021 and well below the 13% reported in 2020.

Private SaaS Growth Rates by Funding Type

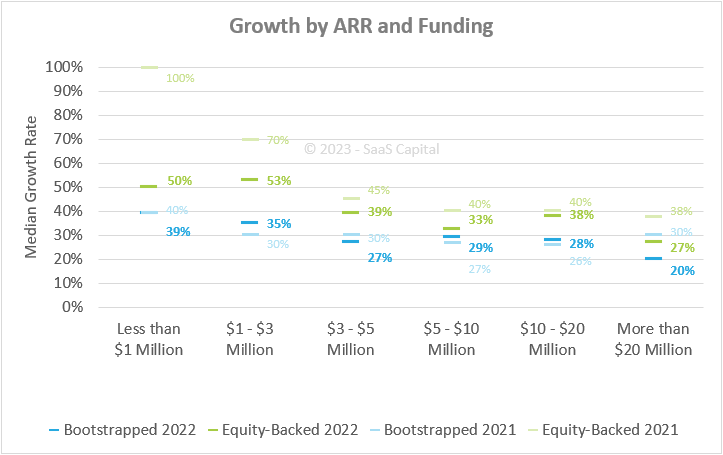

The chart above shows the median growth rates for equity-backed and bootstrapped companies in 2022 versus 2021, broken down by ARR.

Historically, we have seen that equity-backed companies report higher growth rates than bootstrapped companies. And while it’s not clear which is the cause and which is the result since investors look to back companies that already show signs of being high performers, understanding the difference is important for benchmarking.

The chart above shows the median growth rates for equity-backed and bootstrapped companies in 2022 versus 2021, broken down by ARR. And while equity-backed companies are still reporting higher growth than bootstrapped companies, the difference has narrowed. Furthermore, a close examination shows that much of the slowdown in growth can be attributed to equity-based companies, with bootstrapped companies’ growth rates fairly similar between 2021 and 2022. This makes sense as it is only the venture-backed companies that have raised outside capital to grow faster, at the expense of profitability. Bootstrapped companies had to make that choice in the first place, and therefore didn’t need to adjust to the new capital markets environment and investor expectations.

The venture capital gamble is that selling some of your equity for cash for you to spend on growth will allow you to achieve a certain ARR level and growth rate faster than a bootstrapped version of yourself. SaaS valuations are calculated as multiples of ARR, and the single biggest driver of the multiple is the growth rate.

So, a higher growth rate should result in a higher valuation multiple, sooner in the company’s timeline than you would have otherwise achieved by staying bootstrapped. In raising venture, you hope this increased valuation multiple more than offsets the dilutive percentage sold off to investors (AKA, a smaller slice of a bigger pie).

Through our decade-plus of lending to SaaS companies, we have empirically seen that raising venture capital does not change growth rates in a meaningful way. It is far more likely that the VC-backed companies in the survey were already growing quickly before they raised outside capital. This is important to understand as you contemplate the “VC gamble.” Now, venture capital can have real, positive impacts like an accelerated product roadmap, external validation and network effects, and a war chest for acquisitions. But it is important to be honest about how hard it is to bend the growth curve.

Acknowledging our bias as a lender, we consider the engine (the company’s business model and product-market fit) as far more important than the type of fuel (the capital). Pouring VC “rocket fuel” into a rocket may work fine – but it won’t transform a Ferrari (or a Honda) into a spaceship.

Other Takeaways on Private SaaS Growth

The full Research Brief offers additional commentary on the data above as well as breakdowns on growth rate by funding type, growth rate and retention, and growth rate by company age. Key takeaways include:

- The median growth rate for all companies in the survey registered 35.0%. This is down from a population median of 40.0% in 2021 and puts growth closer to the pandemic levels seen in 2020. Overall, only 3.1% of the companies reported flat or negative growth in 2022. That is only marginally higher than the 2.7% of the companies that reported flat or negative growth in 2021 and well below the 13% reported in 2020.

- Growth rate is positively and exponentially correlated with net revenue retention. Increasing Net Revenue Retention (NRR) from the 90% to 100% range to the 100% to 110% range improves growth rate by 9 percentage points. Companies with the highest NRR report median growth that is double the population median.

- Bootstrapped companies report median growth of 32%, up from 30% in the 2022 survey. Equity-backed companies reported median growth of 35%, down from 45% in the 2022 survey. We have long believed that bootstrapped companies are more stable and consistent regardless of the macroeconomic environment, whereas equity-backed companies are by their nature more operationally levered, which will provide a higher variance in results, to both the upside and downside.

- Continuing a pattern we have observed over the years, overall average annual contract value (ACV) levels do not appear to have an overall correlation with growth rate. However, a recent analysis - Changing ACVs: The Hidden Control Lever of SaaS Company Value - revealed that companies that were showing higher ACV growth tend to grow faster, and those with flat to shrinking ACVs grow the least. In other words, increasing ACVs over time is an important component of scaling a SaaS company.

To download the full analysis, please see – 2023 Private SaaS Company Growth Rate Benchmarks.

1 In Q1 of each year, SaaS Capital conducts a survey of B2B SaaS company metrics. This year marked our 12th annual survey, and it continues to grow with more than 1,500 private B2B SaaS companies responding, making it the largest survey of its kind. Below are our findings on growth.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe