Is It a Bubble? – More Thoughts

September 29, 2015

I was recently doing some analysis on the data from our 2015 survey of over 400 private, B2B SaaS companies for our Research Brief on how SaaS companies spend their money, and some of the findings made me think about another, related topic.

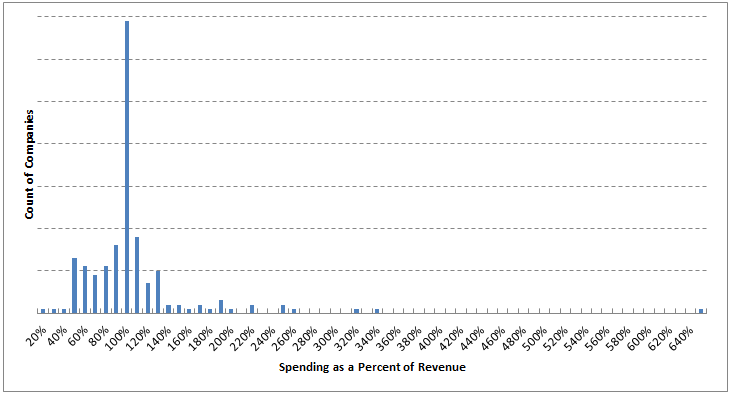

Below is a chart of companies from the survey, sorted by their total spending, as a percentage of revenue. We’ve left out companies with annual revenue less than $1 million as start up spending is interesting, but not comparable to larger, more established companies, which is what we want to focus on here.

When I generated this chart, it immediately reminded me of this blog post addressing venture capitalist Bill Gurley’s comments about the potential for a bubble to be building in the venture and startup industries.

Gurley mentions the potential for a bubble based on high valuations and high burn rates. The comments speak to burn rates, which he defends as reasonable, so long as they abide by the fundamentals of the SaaS business model.

The chart below empirically corroborates his point. By and large, SaaS companies are actually profitable, hardly burning cash at ‘bubble’ levels and some of these companies have raised tens of millions of dollars of venture capital. However, in our survey we don’t ask for data on valuations, so I can’t speak to the potential for a bubble there.

You can clearly see the largest group is operating right at break even, and in fact, the median of this sample is 100%. The average is 104%, skewed by the one outlier at 655% of revenue. Less than 5% of companies in the data are spending more than 2x their annual revenue, meanwhile more than 70% are spending less than their annual revenue. Over 90% of companies are spending less than 1.5x their annual revenue.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe