Growth and Revenue Retention in SaaS Businesses

April 5, 2017

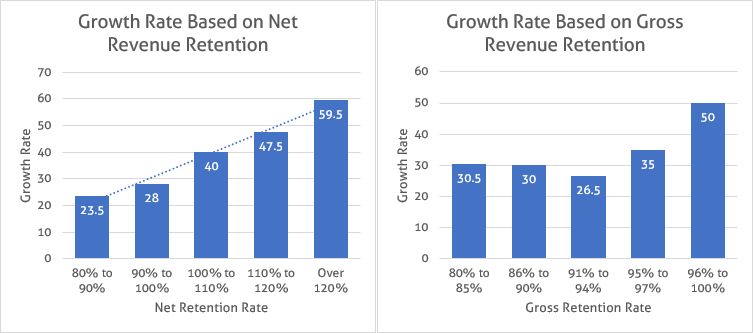

The better a SaaS business is at keeping customers, the faster it will grow. This is not a surprise; however, it’s an assertion that is not typically backed up by real data. The graphs below are based on data obtained from our recently completed survey of over 700 private, B2B SaaS companies and give objective, real-world underpinnings to the relationship between retention and growth.

Net revenue retention, which includes cross-selling and up-selling activity, has the most direct connection to higher growth. Gross retention, however, is also highly correlated to growth. (If you are keeping all your customers, each new one contributes to growth.)

Normally, we qualify our survey data noting that these are correlated factors, and not causal. In this case, however, since both retention measures have a direct mathematical impact on revenue, it’s clear that retention drives growth, and not the other way around.

In the case of net revenue retention, the relationship is so tight, it’s actually easy to estimate exactly how much faster your company might grow if you improve the metric. Each one percentage point improvement in net revenue retention yields a one percentage point improvement in annual growth. Since growth compounds over time, and valuation is predominately based on growth rate, this small improvement can have a significant impact on company valuation in a short time frame.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe