What is the Best Contracting Length for SaaS Companies?

June 30, 2016

We recently published our second research brief of 2016. This study, on how different contracting lengths impact SaaS operating metrics such as revenue growth and churn, is based on data from over 400 SaaS companies whom we surveyed at the beginning of the year.

The study begins with demographic data: not surprisingly nearly half of the respondents contract on an annual basis.

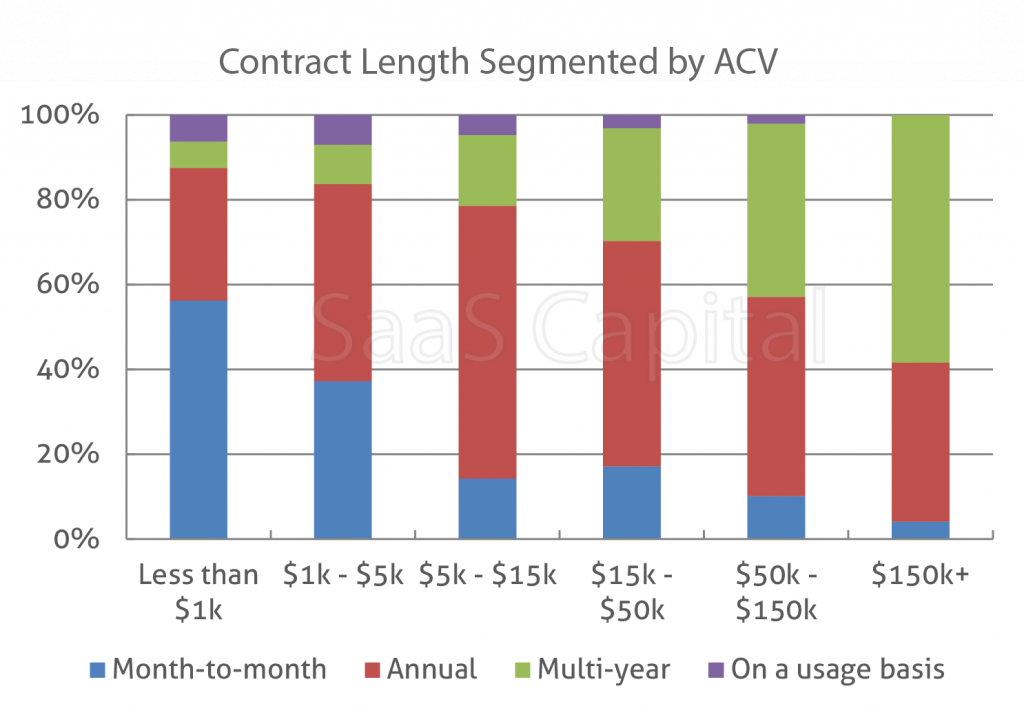

Also, not surprising was the fact that shorter contract lengths were more common in earlier-stage companies and companies selling lower ACV (annual contract value) products. As companies grow, there is a tendency to move up market and increase contract lengths. But should they?

Looking at growth and retention rates across contracting lengths we found something interesting. The higher growth rates of month-to-month-contracting companies far exceeded the negative characteristic of higher churn.

For more detail on these points and their implications, read the research brief here.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe