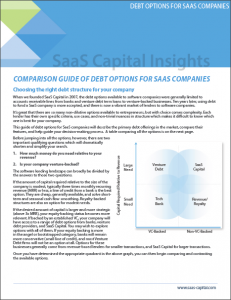

Comparison Guide of Debt Options for SaaS Companies

How to Choose the Right Debt Structure for Your Company

This guide of debt options for SaaS companies will describe the primary debt offerings in the market, compare their features, and help guide your decision-making process.

Click Here to Download the Guide

When we founded SaaS Capital in 2007, the debt options available to software companies were generally limited to accounts receivable lines from banks and venture debt term loans to venture-backed businesses. Ten years later, using debt to fund a SaaS company is more accepted, and there is now a vibrant market of lenders to software companies.

It’s great that there are so many non-dilutive options available to entrepreneurs, but with choice comes complexity. Each lender has their own specific criteria, use cases, and non-trivial nuances in structure which makes it difficult to know which one is best for your company.

We also offer a SaaS debt toolkit, which is a complementary resource to our comparison guide.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read More