5 Drivers of SaaS Valuation: #1 – GROWTH

July 15, 2013

How long will it take to get big, and how likely is it to happen?

The SaaS Capital team has looked at the financials of literally hundreds of businesses over the years. Almost all these businesses were either SaaS companies or had a very similar recurring revenue business model. Drawing from these experiences, we have put together a list of value drivers every seller should pay attention to as they go about preparing for the sale of their company or their company’s stock (an equity raise). Other nuances of your business will undoubtedly impact valuation, but theses are the broad-based value drivers.

Listed in order of importance, they are:

- Growth

- Addressable Market Size

- Customer Retention

- Gross Margins

- Customer Acquisition Costs

In this first in a series of blog posts are going to take a deeper look at GROWTH as a valuation driver.

How does revenue growth rate drive your multiple? Historical growth rate is the single biggest driver of valuation.

In fact, it dwarfs all other factors. The reason growth is so important is that it indicates both the timing and the likelihood of future profits. Faster growth means larger profits sooner, and because of the recurring revenue model, high historical growth rates are a good indication of future growth rates.

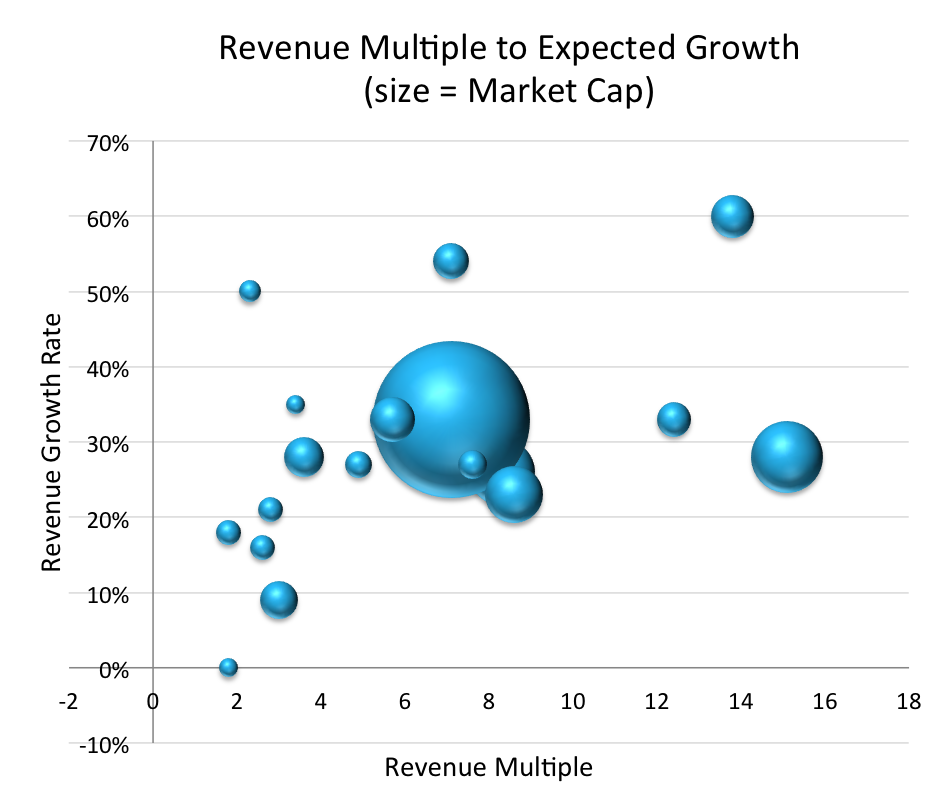

Using public market data, the relationship between growth and a higher revenue multiple is shown in the chart below. The correlation is not 100%, but it’s strong. The faster growing businesses are getting the higher multiples, while the slower growing businesses are getting lower multiples. The outliers on this chart can generally be explained by a large or small Addressable Market, which we will discuss in a future blog post.

As the chart indicates, there are no public SaaS businesses with growth rates below 20% that have a revenue multiple above 3.5x. A 25% level growth rate is a good, bottom of the range, target for emerging private SaaS businesses. Higher growth rates are expected in younger venture backed companies, and lower growth rates are acceptable in more established bootstrapped companies.

In the private capital market, the growth imperative accounts not only for differences in valuation, but also in the likelihood of success.

Slow growth SaaS businesses are difficult to get funded at any price.

These businesses and their existing investors and management must find a way to demonstrate some organic growth that can then be leveraged with additional capital. Only then will it be worthwhile to invest the time and energy in external fundraising. In a recent conversation with a leading SaaS VC firm they commented, “Show me anything that’s growing.”

On the M&A front, the growth imperative is almost as strong. There are exceptions when a corporate buyer is looking for a very specific need that can only be filled by a single company; however, buying criteria generally revolve around growth. “I can’t even take an acquisition opportunity to my CEO unless they are growing faster than we are,” said an SVP in a large SaaS business that is currently growing at 29%.

Sometimes debt financing is used to get a growth program launched in order to demonstrate growth in the business prior to a sale or equity round.

In our next blog post in this series we will take a look at valuation driver #2 – Size of Addressable Market.

To learn more, download our white paper “What’s Your SaaS Company Worth?” for an in-depth look at all five valuation drivers and other considerations when conducting a valuation exercise.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe