What Should a SaaS Income Statement Look Like? (2023 Update)

June 27, 2023

While cash accounting for Software-as-a-Service (SaaS) businesses has some merit, accrual-based accounting is preferred. However, the act of simply accruing and deferring expenses and revenues by itself doesn’t necessarily provide the information needed to understand the health and situation of the company.

A SaaS Profit & Loss (P&L) statement needs to be organized in order to be meaningful to both internal stakeholders and potential external partners, such as capital providers. As the SaaS business model has evolved, it is worth examining what an income statement should look like in 2023.

How Should a SaaS Income Statement be Organized?

Reviewing a company’s financials in a thoughtfully aggregated, trended format remains the number one goal for managers and investors, and the format proposed below accomplishes this concisely and simply. Stakeholders want to see:

- Monthly granularity.

- Revenue (and when possible, Gross Margin) separated into SaaS and non-SaaS if applicable.

- Departmental OpEx, including people costs – but ancillary expenses can be aggregated.

- Customer Success allocated in Cost of Goods Sold (see below for considerations).

- Expensing all software development costs if possible and appropriate.

For bookkeeping purposes, your company will no doubt maintain numerous detailed accounts to accurately track specific assets, liabilities, revenue streams, and cost centers. But at the managerial level, what should an effective subscription-based income statement, or profit and loss (P&L), report look like? What’s the proper level of granularity in the accounts? Where should certain accounts be categorized? What’s the correct level of detail and organization to share with outside advisors and investors?

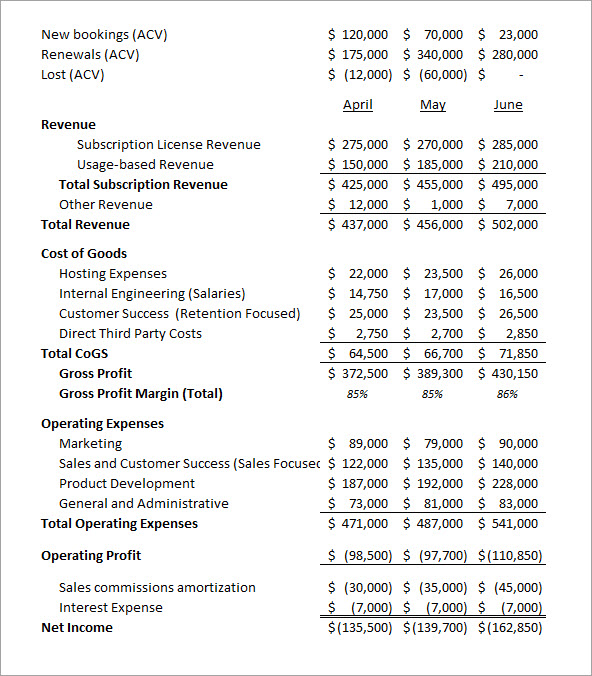

SaaS Income Statement Example

Below is a fictional, but realistic, SaaS company income statement organized correctly for understanding the drivers and trends in the business. (Note: you can download a SaaS Income Statement template at the end of this post.)

The Income Statement above incorporates the following concepts:

- Periodic Granularity. Monthly-level granularity, in a series. In SaaS, trends are key, so monthly is the right level of detail, especially for early-stage, fast-growing companies. As an operator inside the business, you’re likely reviewing some data on a weekly, daily, or even hourly frequency. But for the management P&L, revenue, expenses, and profit/losses are best reported at the monthly level. Quarterly and Annual-level detail is insufficient to track meaningful trends, issues, and opportunities in a SaaS company that is only 2 to 5 years old. If you don’t close your books on a monthly basis, well, you need to start.

- Account Granularity. Notice that there are actually more line items under Cost of Goods Sold than in Operating Expenses! In SaaS, it’s all about the margins, baby! This P&L has a fairly detailed breakdown for COGS because those are the costs that ‘really’ matter in SaaS. Gross Margin – including breaking out the pure SaaS gross margin, if non-SaaS revenue is more than 10-15% of the total – is the fundamental health metric for the business model itself. Individual operating expenses (postage? furniture?) under Operating Expenses tend to be more noise, and can usually be aggregated. Some additional breakout for marketing spend, such as tracking advertising separately, may be appropriate – but again, you’re likely tracking marketing performance in a much more detailed manner elsewhere. (Note: this post has more about COGS for SaaS businesses.)

- Payroll Granularity. If at all possible, people costs should be reported under the broader category (such as Customer Support or Research & Development), not as an aggregated “Payroll” account. This goes for contractors as well, if a significant portion of your people costs are 1099 contractors.

- Customer Support. It is now established best practice to include the customer support and customer success department in Cost of Goods Sold. (See below, however, if you have staff working on upsell/cross-sell.)

- Software Development Costs. Expense your software development costs, don’t capitalize them. Capitalization accomplishes very little and requires some mental gymnastics to fully understand the impact to cash. (This is management advice, not tax advice, however – see below for more on this topic.)

- A small, last point: this export is in Excel, not a PDF, on a monthly level with all periods on the same sheet. QuickBooks’ default exports (PDF, with each period separated from the others) are a really difficult format to work with, so exporting into Excel with the correct date range and periodic granularity is key.

SaaS P&L Changes

The income statement example above incorporates a number of changes that have evolved over time.

- More granularity in the revenue accounts where appropriate. With a general trend towards more usage-based pricing, we’ve found it helpful to break software revenue into its component parts. These breakouts can be by product or feature name, by customer segment, by revenue type (e.g., usage vs. license), or any other categories that are relevant to your business. This granularity is particularly valuable if different areas of the business are trending in different directions or have different characteristics. And, of course, if there is material non-software or non-subscription revenue – like hardware or professional services – those must be broken out separately (ideally with corresponding COGS, too).

- Allocating Customer Success into “sales” and “support.” It is now fairly established that Customer Success activities fall into two different categories: more sales-oriented work, focused on renewals, upselling, and cross-selling, and more support-oriented work, focused on user experience, training, and feature education. These work efforts might be undertaken by two totally separate teams, or by the same single employee, but the support-oriented expenses should be allocated in COGS, and the sales-oriented expenses should be either grouped with Sales expenses or have a separate line item next to Sales.

- ASC 606. This accounting rule change, which took effect in 2019, doesn’t impact how you should format your P&L, but it certainly impacts revenue and even cost recognition, so it is definitely something to be aware of. In our experience, most SaaS companies that have adopted accrual accounting are largely on track with ASC 606, with allocation of implementation costs and revenue being sticky points. See this post for detail on the changes required by ASC 606.

- Below the line items. ASC 606 has made tracking amortization more important. ASC 606 requires capitalization of sales commissions over the life of the contract. It may be worth breaking this out and, separately, any software development cost amortization specifically from a broader depreciation and amortization category.

- Bookings/Renewals/Churn at the top. Except for self-service SaaS products, most companies who “sell” B2B SaaS will have some meaningful difference between MRR booking versus MRR Especially if growth is accelerating, the difference between the two may be crucial to understand. If you are presenting or sharing the P&L as the singular snapshot of the business, a line above the P&L tracking bookings by month is very helpful. Even better, you can also show renewals and churn, as illustrated in the example. These are typically shown as ACV booked/renewed/lost in the month. (Note that these amounts won’t directly tie to the P&L revenue trend due to implementation, invoicing, and revenue recognition timing, but again, it’s good trend data for the viewer.)

A Note on Capitalization (Updated 2023)

“Capitalizing software development” basically means skipping the income statement and pretending that the cash that you pay your developers is still in the business, just moved from the bank account to an intangible asset account. It doesn’t take much foresight to realize, though, that you can’t reverse that process and “spend” that asset on something else.

That’s why we at SaaS Capital have consistently been vocal against the practice of capitalizing software development in private B2B SaaS companies. The most important reason is that it obscures the uses of cash, and most early- to growth-stage B2B SaaS companies are, prudently, managing very tightly to cash flow. There are other reasons, too, such as management complexity, and the fact that the useful life of any particular code developed for B2B SaaS might be as long as decades or as short as weeks – it’s very difficult to predict. Finally, B2B SaaS companies are always writing some new code, whether it’s bug fixing or new feature development, so it “looks” like ongoing OpEx.

However, recent tax law changes taking effect in 2022 may require an approach of capitalization for tax purposes only. We think that 1. Congress is likely to “fix” this tax law change, though it’s hard to know when, and 2. it’s still better to manage the business without the distortion of capitalizing software. So we recommend that your tax returns, if necessary, comply with the current tax law, but that your Income Statement should follow the guidelines above.

As noted above, a SaaS P&L statement requires an organization to be meaningful to internal and external stakeholders. Consistent reporting helps business owners better run their SaaS companies and helps investors better understand the business, which leads to quicker decisions.

For early-stage SaaS companies (before seeking the help of a CFO), we have additional thoughts on the basics of what a “management” Income Statement should contain as well.

Note: A version of this post was first published in 2015, and most recently updated in 2023 to reflect current best practices.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe