2025 Benchmarking Metrics for Bootstrapped SaaS Companies

April 30, 2025

Over the 14 years that SaaS Capital has been conducting its annual survey of private, B2B SaaS company metrics, many patterns have emerged. One is that there is a clear difference between the metrics of VC-backed and bootstrapped companies.

Overall, VC-backed funding has generally correlated with growth and a high burn rate. It may not be a causal relationship with growth, but there has been a historical relationship. VC-backed companies are typically operating at a loss to support that growth. Meanwhile, bootstrapped companies tend to show lower growth rates but are generally spending less and are profitable.

There is a healthy debate to be had about whether a SaaS company should seek to raise VC funding or go the bootstrapped route. Much of that though really depends on company specifics and the goals of the founders.

SaaS Capital works with both VC-backed and bootstrapped SaaS companies and has seen the advantages of each path. But one group that stands out, both in terms of discipline and long-term opportunity, is bootstrapped SaaS companies with $3M to $20M in Annualized Run Rate Revenue (ARR).

Getting to $3M in ARR without outside capital is no small feat. It usually means the team has found product-market fit, built efficient go-to-market motions, and maintained a level of cost discipline that many VC-backed peers never have to develop. But what’s even more interesting is what happens next.

Growing from $3M to $20M as a bootstrapped business is where real leverage begins to show. This is the stage when owners can start building meaningful enterprise value without giving up control. Margins tend to improve, infrastructure becomes more efficient, and systems begin to scale. The business shifts from “is this going to work?” to “how do we maximize what’s already working?”

There is still risk, but it becomes more strategic than existential. Decisions around how to fund growth, when to hire, and where to invest become more nuanced. Leaders in this stage are often focused on building repeatable systems, recruiting selectively, and staying lean without slowing momentum.

To support companies in this position, we are focusing on benchmarking metrics specific to scale-stage bootstrapped SaaS companies. The goal is to give founders and CFOs better visibility into how peers are navigating this phase on metrics such as growth, retention, and spending.

If you’ve bootstrapped your way into the $3M to $20M range, you are already in rare company. We want to help you understand just how rare, and just how valuable, that position really is.

2025 Benchmarking Metrics for Bootstrapped SaaS Companies

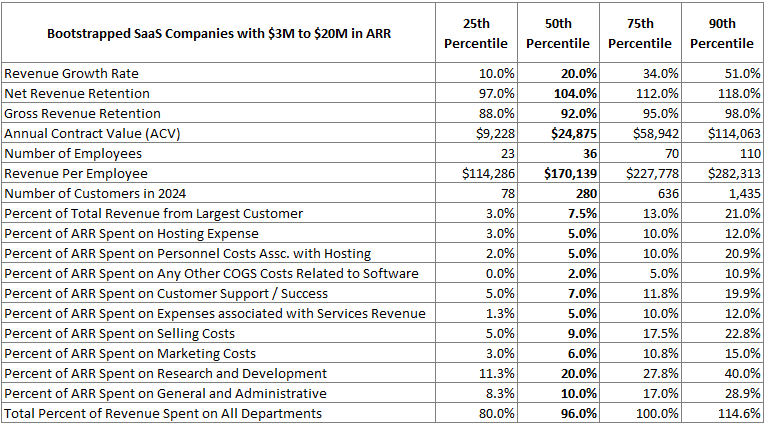

The data above comes from this year’s survey of more than 1,000 private SaaS companies. To help founders and CEOs of bootstrapped SaaS companies understand how their company compares to their peers, we used percentiles to describe the range of the data. A few key metrics:

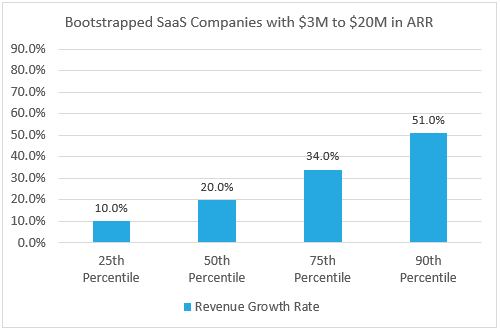

2025 Bootstrapped SaaS Company Revenue Growth Rates

The median growth rate for bootstrapped SaaS companies with $3M to $20M in ARR is 20%, while those in the 90th percentile are growing by 51%. This is down from the median growth of 30% in the previous year while those in the 90th percentile dropped from growing at 75%.

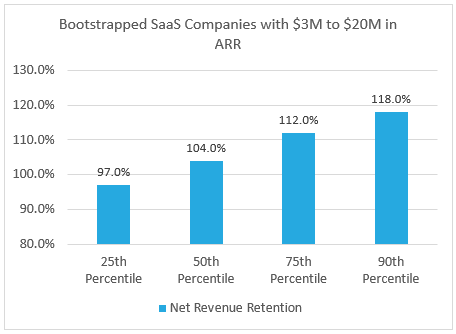

2025 Bootstrapped SaaS Company Net Revenue Retention Rates (NRR)

The median Net Revenue Retention (NRR) for bootstrapped SaaS companies with $3M to $20M in ARR is 104% while those in the 90th percentile report NRR of 118%. While growth is down vs. the previous year, median retention is up slightly (from 100%).

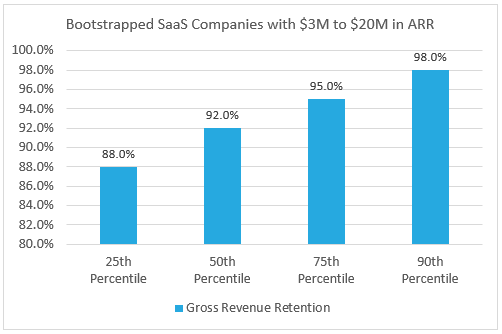

2025 Bootstrapped SaaS Company Gross Revenue Retention (GRR)

The median gross revenue retention for bootstrapped SaaS companies with $3M to $20M in ARR is 92% while those in the 90th percentile report gross retention of 98%. These figures are essentially flat vs. the previous year.

Conclusion

The scale-up phase offers a tremendous value-creation opportunity for the founders of bootstrapped SaaS companies. In addition, many bootstrapped companies are operating near breakeven, or are profitable, which avoids the need to pivot from the “growth at all costs” mindset during times of uncertainty. We hope these benchmarking metrics offer a valuable resource for the founders and CEOs of bootstrapped companies.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe