How Fast Should My SaaS Company Be Growing (Now)?

May 22, 2015

We asked this question two years ago and the answer is the same: We have no idea how fast your company should be growing. But we just completed our 2015 survey of private SaaS companies, with our highest number of respondents ever, at 409. So we know how fast a lot of your peers are growing.

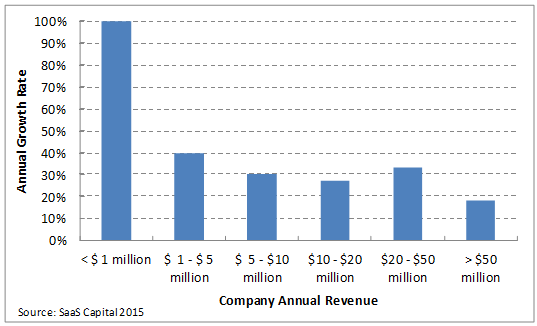

Below is an update to the chart published in 2013; the chart shows the median growth in revenue from 2013 to 2014 by company size (annual revenue), as reported in our Q1 2015 survey.

Things to note in the data:

- Apparently no companies are shrinking. The lowest growth rate entered in the entire survey was 0%.

- It’s increasingly hard to maintain the same growth rate as you get bigger. This is just math: as your denominator (previous period revenue) grows, you have to increasingly increase your new sales to maintain the same growth rate. This is really hard, and eventually impossible (the old b-school DCF ‘g’ has to be smaller than long term GDP growth, otherwise your company would eventually be bigger than the entire world’s economy); we expect to see it, and it’s nice to see this show up in ‘real world’ data. Stay tuned for an upcoming Research Brief diving into more detail on this topic.

- Growth rates in the two smallest company categories are much higher than two years ago. Not to under-appreciate the achievements of the startups, but the more meaningful one of the two, again, because of the math, is the $1-$5M company grouping. In our previous report this group was growing at a median of 32%, while this year these companies are growing at 40%.

- As there was in 2013, there is a bump in growth rate once a company hits the $20M revenue mark. Our original explanation for this increased growth rate was an increase in accessibility of private capital at run rates above $20M. Today we find this explanation is as valid as ever, and in fact, based on conversations we have had with SaaS companies and investors alike, more growth equity investors are ‘dipping down’ to make investments in companies with $10M in revenue and up. This likely explains the increased growth rate in the $10 to $20M group to 27% versus 22% two years ago.

- Not all of the increased growth is necessarily attributable to increased capital availability. The SaaS industry is two years more mature than our last report on growth rates. SaaS metrics, best practices and ‘playbooks’ have been more thoroughly developed and standardized. Also, there are more tools than ever to help companies scale efficiently, from CRMs to marketing automation, to finance and billing, leaving more dollars available to plow back into sales and marketing.

- Lastly, we’re still in a prolonged bull market. It will be interesting to see what these growth rates look like when (not if) there is a market pullback.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe