Retention Benchmarks and Analysis for Channel Sales in SaaS

August 9, 2019

For the last two years, we have devoted several questions in our annual SaaS metrics survey to the area of channel sales. In our recently released research brief on revenue retention, we analyzed the channel sales data in relation to churn. Below are some of the key findings.

Of the companies who responded to the survey, 52% have some form of channel program and 48% sell completely directly. There was no difference in retention rates between the two groups; both reported about 100% net revenue retention and 90% gross revenue retention.

Companies that receive the majority of their revenue through a channel partnership, however, have a 3-percentage point lower retention rate than companies for whom a majority of sales is direct.

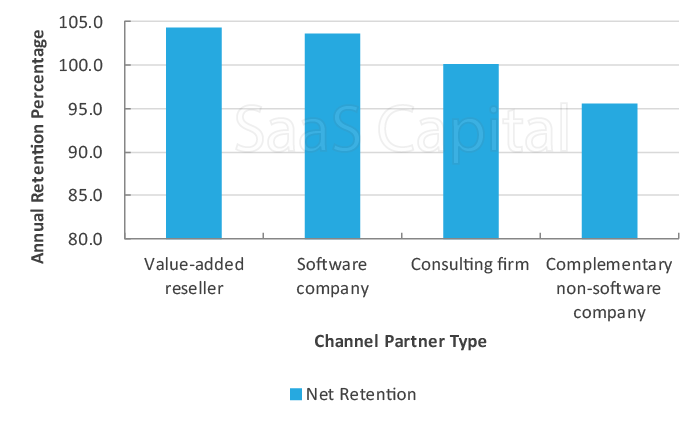

We asked what type of partner the company typically worked with and how the channel sales were typically conducted. Whether via a simple referral from the partner, a jointly sold deal, or a completely hands-off white-labeled sale, the data showed no difference in retention based on the sales strategy. Net retention was also about the same across the two most common types of partners: VARs and other software companies. However, net retention was weaker with consultants and “complementary non-software companies” (who are mostly hardware companies). We suspect net retention from these partners was weaker than the other partners because of the difficulty in cross-selling in these relationships. While they differ in their ability to upsell, all partners appear equal in their ability to retain customers: gross retention was about equal across the four partner types.

The general takeaway from our research is the use of channels does not necessarily or automatically lower customer retention significantly as some companies fear. That said, heavier channel use is correlated with modestly lower retention, and nowhere did the data suggest channel sales were correlated with better retention.

For more retention benchmarks and analysis, you can download our full report here: 2019 B2B SaaS Retention Benchmarks

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe