The SaaS Capital Index

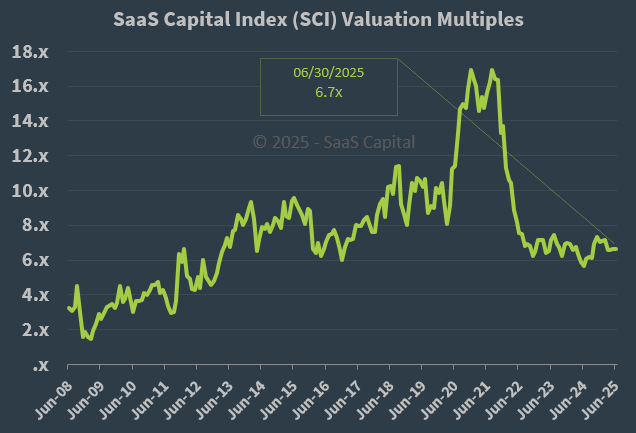

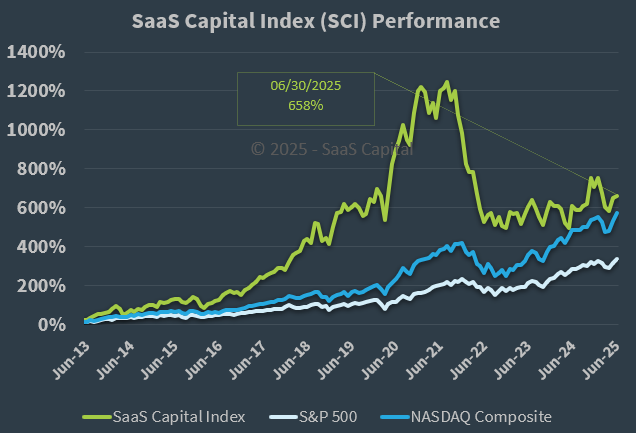

Public company data is the best starting point when valuing a private Software-as-a-Service (SaaS) business, so we created the SaaS Capital Index™ to be the most accurate, up-to-date valuation tool for pure-play, B2B, SaaS businesses.

The SaaS Capital Index™ is designed to be used in combination with the white paper What’s Your SaaS Company Worth? as the starting point for comprehensive valuation analysis.

Data as of: 06/30/25

The SaaS Capital Index™ differs from other SaaS stock indices in the following ways:

- The revenue multiple is based on annualized current run-rate revenue, not trailing or projected revenue. We believe run-rate revenue is the most accurate and objective measure of the current scale of the business and, therefore, the best measure to be used for valuation purposes.

- The index excludes SaaS companies serving B2C customers and very small B2B companies with annual revenue per customer of less than $500. Companies targeting these end users have customer acquisition and retention dynamics that are significantly different than those of traditional B2B SaaS businesses. Examples of excluded SaaS companies in this category include Box, Dropbox, Carbonite, and 2U.

- SaaS business with “mixed” revenue streams, which include significant amounts of perpetual or maintenance revenue, hardware sales, telecom minutes, or other “non-SaaS” revenues, are excluded. The gross operating margins, cost structures, and revenue volatility of these companies do not fit the traditional SaaS model. Examples of excluded companies in this category include Oracle, Microsoft, Square, and Twilio.

- SaaS consolidators such as Constellation Software are also excluded for a variety of business model reasons.

We compiled the SaaS Capital Index™ for the first time in Q3 2019, and while the historical data goes back many years, it only includes data from active SaaS businesses in Q3 2019. Since Q3 2019, however, we have added new qualifying SaaS companies as they have gone public. Acquired or delisted companies remain in the historical data.

Comments and questions about the SaaS Capital Index, can be sent here.