Cash Flow Dynamics in a Shrinking SaaS Business

March 19, 2020

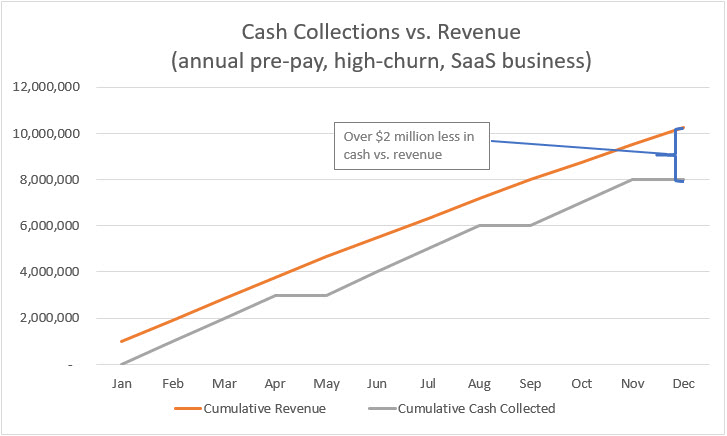

If a SaaS business is charging its customers annually in advance, and that business starts to shrink, teams and investors must be acutely aware that its cash flow will go down much quicker than the P&L will indicate.

When an “annual in advance” SaaS business shrinks, it “consumes” deferred revenue, which generates no cash. Renewals and new bookings, sources of cash, are not keeping up with churn and revenue recognition. Obviously, recognized GAAP revenue starts to go down, but it only goes down by the monthly payment amount of the lost customers, while the real cash impact is a year’s worth of payments that will not be collected.

The chart above shows the cumulative MRR for a business over a year (orange line) as compared to the cumulative cash collections for the same company over the same period (gray line). In this example, churn is really high (33%) to make the point clearer. For the year, revenue went down $1,750,000, but cash collected from customers went down $4,000,000. That difference will show up on the balance sheet and cash flow statement as a decrease in deferred revenue, and it will obviously show up in an empty bank account.

CFOs and CEOs doing real financial projections will capture all of this, of course. Still, everyone must be attuned to the sensitivity of cash burn based on different assumptions of renewals.

If an annual in advance SaaS business faces a wave of churn, it will be out of cash almost immediately, well before the P&L would show it.

Cash in bank/EBIT is not a useful predictor of runway in this scenario.

For more on this topic, including an Excel workbook containing data from SEC filings, please see How Do SaaS Companies Perform in a Recession?

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe