SaaS Capital 2020 Observations and Thoughts for 2021

December 15, 2020

In last December’s recap, we said that we believed the economy and capital markets would tighten over time. We did not expect a pandemic and the suddenly volatile year we have all experienced.

Below are our observations on the SaaS and economic markets in 2020, some thoughts looking forward, and a recap of our year.

- Q1 performance for most portfolio and prospect companies hit their original plans. Sales pipelines and cycle times were disrupted in Q2, but customers resumed purchasing in Q3, often on shorter cycles than pre-pandemic.

- Companies with month-to-month payment terms experienced a sharp spike in churn in Q2 and were forced to offer short-term concessions to preserve long-term relationships. That said, these companies experienced a deep but relatively short V impact to revenue, with most customers returning in Q3. Companies with longer contract lengths saw only a minimal Q2 increase in churn, if at all.

- Innovation was strongly rewarded during Q2 and Q3, and multiple portfolio companies that offered new features, modules, or options to address the pandemic enjoyed better retention and hypergrowth in sales.

- SaaS companies, by their nature, are well-suited to a work-from-home environment, and all companies we’ve spoken to transitioned quickly and easily. Many portfolio companies have embraced remote work and now have no geographic restrictions on new hires. Customers have also transitioned to remote work, and as mentioned above, are now choosing software vendors remotely, and often in quicker processes than before.

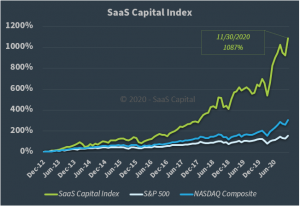

The Paycheck Protection Program (PPP) loans were available to every one of our portfolio companies that wanted one, and all expect 90% or more of the loan to be forgiven. Software has been a bright spot in the economy through 2020. The SaaS Capital Index’s over-performance relative to the broader indices has accelerated, with the median public SaaS company valuation multiple standing at 15.6 times ARR as of November 30th, the highest ever. To date, we have not seen the public run-up cause a similar rise in private company valuations. Anecdotally, private valuations remain in their historical range of 3x to 8x ARR.

The Paycheck Protection Program (PPP) loans were available to every one of our portfolio companies that wanted one, and all expect 90% or more of the loan to be forgiven. Software has been a bright spot in the economy through 2020. The SaaS Capital Index’s over-performance relative to the broader indices has accelerated, with the median public SaaS company valuation multiple standing at 15.6 times ARR as of November 30th, the highest ever. To date, we have not seen the public run-up cause a similar rise in private company valuations. Anecdotally, private valuations remain in their historical range of 3x to 8x ARR.- There continues to be vast amounts of private capital looking to invest in SaaS companies, which, if the public markets remain at their current levels, may eventually pull private valuation multiples up into the double digits. That said, speaking to a private equity investor last week, he said: “It’s just really hard to justify paying more than three or four years’ worth of revenue for a small, unprofitable, early-stage company, regardless of growth.”

- With several vaccines on the horizon, we expect to see the economy stabilize in a significant way by the second half of 2021. There are theories of a repeat of last century’s “Roaring Twenties,” led by an explosion of pent-up demand in retail, hospitality, travel, and entertainment over the next several years.

- Cloud-based software continues to expand across all industries with no indication of adoption slowing.

SaaS Capital in 2020:

- An unintended consequence of the PPP was that our deal flow was temporarily depressed during Q2. The combination of preemptive staff reductions, an influx of cash from the government, and continued uncertainty about the length and depth of the crisis caused companies to defer making capital decisions. From conversations with VCs and PE investors, this slowdown in financings extended throughout the entire market.

- We provided growth debt to six new companies, below our typical pace of 10 to 12 deals per year. This was both a function of the market, as mentioned above, and our own added diligence and cautiousness following the pandemic. We are pleased both with our underwriting and deal flow, as well as the quality of the companies added to the portfolio.

- Q3 more than made up for the quiet Q2, with five portfolio companies signing LOIs to be acquired or raise equity. Importantly, none of those transactions were due to poor performance during the pandemic; all of the companies are performing well and choosing to exit or raise money for opportunistic reasons.

- We participated in two great webinars on the impact that retention has on valuation and capital efficiency in SaaS companies, created 3 research papers on the SaaS business model and benchmarking data, and published 11 shorter blog posts on those topics as well.

- Finally, we are just finishing up expanded research on capital efficiency. Look for that in your inbox next week.

Always, but especially this year, we feel thankful to our portfolio company management teams, limited partner investors, industry partners, and friends. We hope you remain safe and wish you all the best of luck in 2021.

If you, or a SaaS company you know, is thinking about fundraising in 2021, please keep SaaS Capital in mind. We lend $2 million to $10 million to B2B SaaS companies with at least $250k in MRR registered and banked in the US, Canada, and the UK.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe