New “How to Value a SaaS Company” Framework for 2022

August 11, 2022

SaaS Capital is a provider of debt financing for private B2B SaaS companies. Since 2007, we have lent to nearly 100 such firms and observed over 50 of those companies undergo arm’s length, private-market, cash valuation events (about half M&As, half equity raises). Using this information, we have published a 2022 update to our What’s Your SaaS Company Worth? white paper. This revision is a major one, with important updates to our methodology and the underlying data. Here are the key highlights of this new SaaS valuation framework.

SaaS Valuations Use ARR Multiples

Any business has an intrinsic value equal to the net present value of its future profits. However, SaaS businesses tend to have:

- High, consistent growth prospects (it is possible to grow to many multiples of the current revenue run-rate).

- Low-risk unit economics (it is possible to become profitable after reaching modest scale).

Therefore, for a SaaS company, the value of far-future profits following a long period of compound growth dwarfs the value of trying to turn a profit early (at the cost of continued growth).

This means that SaaS companies by and large choose to stay unprofitable and continue growing, which in turn makes using current profits (earnings) impractical.

As a result, the market has adopted a shorthand method for valuing growing SaaS companies relatively simply, using a multiple of annualized recurring revenue (ARR).

Company Valuation = ARR * Valuation Multiple

Determining the suitable valuation multiple, therefore, is the crucial exercise. The right multiple depends not only on the company’s characteristics, but on broader market conditions at a point in time. There is no one-size-fits-all multiple – but it is possible to make an informed, data-driven estimate, which is what we lay out below.

Key SaaS Valuation Multiple Drivers

Three primary factors drive SaaS valuation multiples:

- Capital market appetites for owning SaaS businesses (external).

- Revenue growth rate (company-specific).

- Recurring revenue quality (company-specific).

There are many other factors that may come into play during a negotiation, but assuming a SaaS company falls within a generally acceptable range (see “Important Assumptions,” below) for most of its metrics, the three factors above will be decisive.

Our methodology uses the following inputs to account for these three factors:

- The current level of the SaaS Capital IndexTM (SCI).

- The company’s current ARR Growth Rate.

- The company’s Net Revenue Retention (NRR).

We briefly discuss each of these, and how to calculate them, in the sections that follow, before turning to how to derive the baseline multiple and apply it in practice.

SaaS Capital Index (SCI)

The SaaS Capital Index Median ARR Multiple follows 91 public companies, carefully curated by SaaS Capital. We include only B2B software with recurring revenue models. We exclude companies where a major portion of revenue is due to services, consulting, payment processing, etc.

We then use the public market capitalization for each company to determine its valuation multiple. The median value of these multiples is the SaaS Capital Index Median ARR Multiple at a point in time.

Historically, the SCI has usually been observed between 5x-10x, and private companies generally trade at a discount to this public multiple. The SCI is updated monthly with current ARR multiples and the new valuation framework offers important points to consider, particularly around the best use of aligning timeframes.

The SCI level is well-correlated with the observed valuation events, but outcomes are varied enough that the SCI is not sufficient to use on its own.

ARR Growth Rate

ARR growth rate is a crucial company-specific metric, and it’s important to calculate it correctly, not merely to use a generalized estimate of “revenue.” ARR Growth Rate should be annualized, actual, and trailing (not “forecast” or “projected”).

ARR Growth Rate is highly correlated with valuation multiples, although we can still make a better estimate by using it in combination with other factors.

Net Revenue Retention Rate

Retention is considered an important quality-of-revenue metric, and Net Revenue Retention (NRR, or less commonly Net Dollar Retention or NDR) is a fairly universally measured quantity that also has been shown statistically to have a correlation with valuation. While it is related to growth, NRR contains more information about revenue quality, customer satisfaction, and pricing power than does growth rate alone. (Note you can more on calculating NRR here.)

Why Multiple Factors are Necessary for SaaS Valuations

An example from real estate may be helpful here. House prices in the broad market are often spoken of in terms of price per square foot. However, two houses of identical size might be situated in different neighborhoods with different fixtures, like the furnace or roof.

The house with the more desirable neighborhood, or with the better fixtures, will likely sell for a higher price than an identically-sized house with less desirable neighborhood, or fixtures needing maintenance. A price estimate that considers those factors will be substantially more accurate than one that does not.

Similarly, the SCI is a general market indicator akin to the price per square foot, and ARR Growth Rate and NRR Rate are deal-specific factors, like neighborhood and fixtures, which considerably improve the accuracy of a valuation estimate. Our methodology, summarized below, uses statistical methods to apply the right weights to the different factors so as to match our dataset.

Important Considerations for Using the Baseline Valuation Multiple in Practice

Even the best mathematical model will only provide a starting place, and can never account for things like negotiation styles, moods, and perceived urgency that strongly influence how real deals get priced.

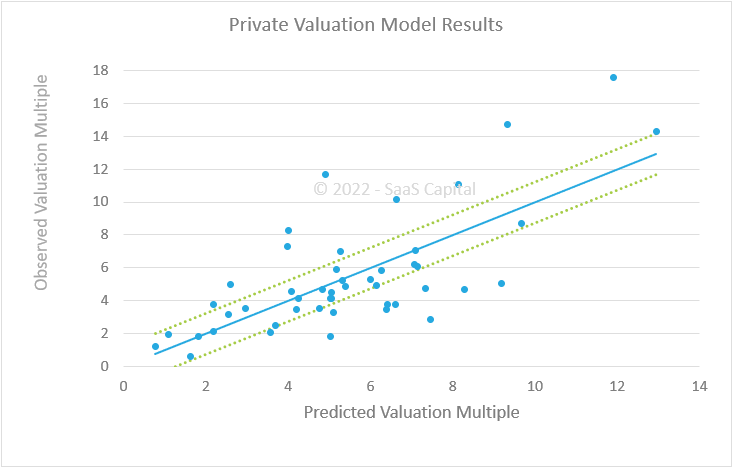

That said, our methodology is a pretty good starting place, and has held up over many years and changing market conditions. As shown below, a majority of actual Valuation Multiples were within +/- 30% of the predicted multiple, and likewise a majority were within +/- 1.25x of the predicted multiple.

It is also important to verify that the company meets all the “Important Assumptions” section in the white paper. If the inputs do not fall in the Input Domains, or, if the baseline Valuation Multiple is outside the Output Range, or, if the company does not meet the assumptions of Threshold B2B SaaS Metrics, proceed with caution and consider using a different methodology.

Baseline Valuation Multiple Formula for Private SaaS Companies

The baseline Valuation Multiple can be calculated directly using the formula below:

Valuation Multiple = -3.2 + (0.32 * SCI) + (8.26 * ARR Growth Rate) + (2.62 * NRR Rate)

Note that the first term is a negative term (-3.2), so take care to watch the sign when using it! (The specific numbers in this formula, like -3.2 or 2.62, are empirically derived using statistical methods outlined in the valuation multiple research. They don’t have obvious meanings outside of the overall formula, so we caution against attaching meaning to those terms. For illustration, consider a private SaaS company with:

- ARR of $5.0 million

- ARR growth rate of 40%

- Net revenue retention of 105%.

We wish to estimate the valuation that would apply to a transaction priced in May, 2022, when the SCI is at 9.1x. We would apply the formula as such:

-3.2 + ( 0.32 * 9.1 ) + ( 8.26 * 0.40 ) + ( 2.62 * 1.05 ) =

-3.2 + 2.912 + 3.304 + 2.751 = 5.77

Therefore, the applicable baseline Valuation Multiple would be 5.77x, implying a company valuation of approximately $28.8 million.

Conclusion

In addition to the formula noted above, the white paper includes a baseline valuation multiple table and an Excel spreadsheet for calculating baseline SaaS multiples. And, as noted above, it’s important always to use the most recently published versions of the white paper and of the SaaS Capital Index, which can be found here:

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe