New Retention Data and the Impact on Valuation

June 26, 2020

As regular visitors (and those on our research distribution list already know), SaaS Capital has been conducting an annual survey for many years. This year’s survey, with 1,400 private B2B SaaS companies, was our largest yet. The goal of the survey is to provide comprehensive benchmarking data for private SaaS companies on a variety of metrics. One of the most popular is the issue of churn.

Because of its compounding effect on growth, revenue retention is now well established as the most important metric for ensuring medium- to long-term business health. New sale bookings versus revenue retention are the SaaS version of “offense wins games, defense wins championships.”

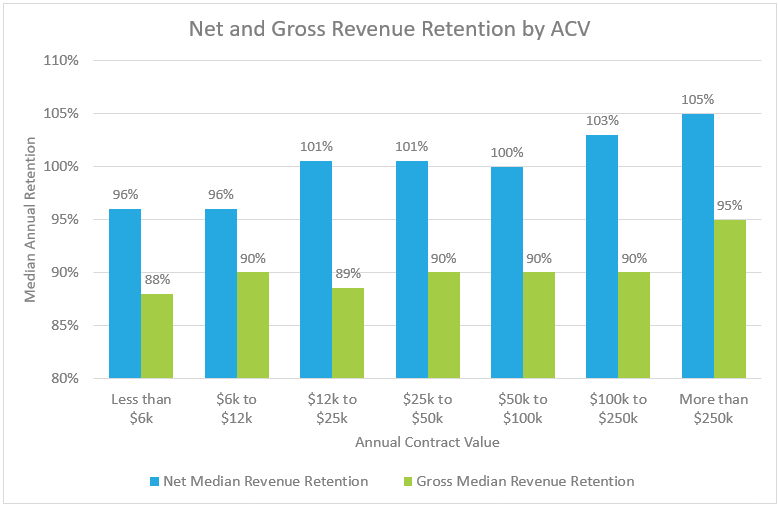

Earlier this month, we published our 2020 B2B SaaS Retention Benchmarks, which explored retention benchmarks across a range of breakdowns, including annual contract value (ACV), growth, channel sales, venture-backed companies compared to bootstrapped companies, and other breakdowns. The chart below shows one of the key benchmarking points, which is median net and gross revenue retention across ACV.

For retention, benchmarking by ACV is the best starting point. More than by company age, revenue level, or industry, companies that share a similar selling price have the most in common. They will be organized similarly, go to market similarly, and support customers similarly. The opposite is true of two companies selling a $19.99/month product versus a $250,000/year product.

This year’s survey shows higher net retention is now correlated with higher ACVs, which marks a shift from previous years where gross retention levels were directly correlated with higher ACVs. While the data still shows that the companies with the very highest ACVs reported the highest gross retention, gross retention is relatively flat across the rest of the board. As the Research Brief notes:

Data from our own portfolio and discussions with prospective borrowers have revealed that gross retention is becoming the more “natural base” retention.

Other key findings from our research include:

- Across all SaaS companies, median net retention is 100%, and median gross retention is 90%, consistent with prior years’ data.

- High growth and high retention are correlated.

- Except for very low growth or shrinking companies, gross retention appears uncorrelated with growth rates.

- Venture-backed companies reported similar gross retention as bootstrapped companies, marking a change from previous years.

- Virtually no difference in retention rates between companies that receive customer payments primarily on a monthly basis versus those that predominately take annual up-front payments.

For a full breakdown of the findings, including background on the methodology and definitions, please see download the research.

Building on this research, Rob Belcher joined You Mon Tsang, CEO & Founder of ChurnZero, and Allen Cinzori, Managing Director of Software Equity Group for a webinar last week.

In How Do You Rank? Understand the Growth and Retention Metrics of SaaS Companies from Recent Surveys and M&A Activity the group discussed the survey data and covered:

- How customer retention impacts the valuation of your company

- The compounding effects that churn has on your bottom line

- How Customer Success can effectively drive retention

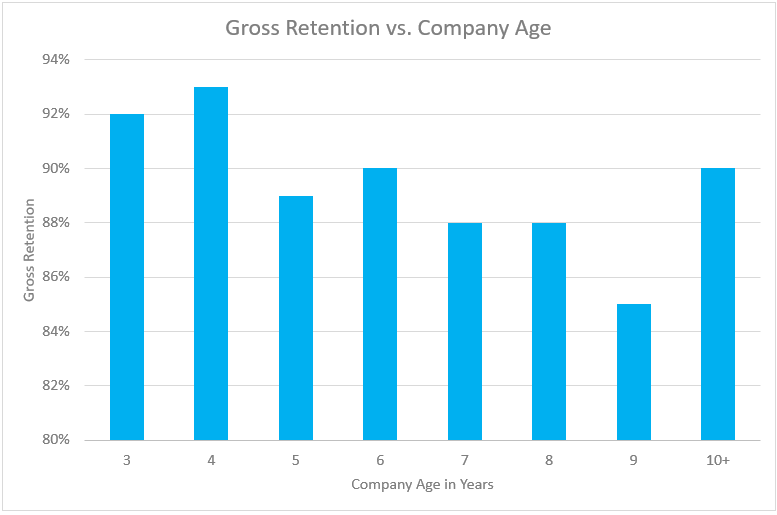

In the presentation, Rob presented new data that looked at retention based on company age.

What’s interesting here is that retention actually decreases as a new company starts to mature. While this might seem ominous, given the importance of fighting churn, Rob explains that this is to be expected. The theory is that when a company is young, all of its customers are essentially new and, therefore, just haven’t had a chance to churn out yet. In other words, retention isn’t necessarily overstated, there just hasn’t been enough time yet to fully play out.

Rob’s detailed explanation and the full webinar can be found in the video below.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe