When is a Good Time to Sell a SaaS Company?

February 21, 2020

A feature of a sustainable recurring revenue business model is that, unlike other business models, you can pretty much know your company’s valuation at any time, and depending on how confident you are in your forecasts, project it out into the future as well.

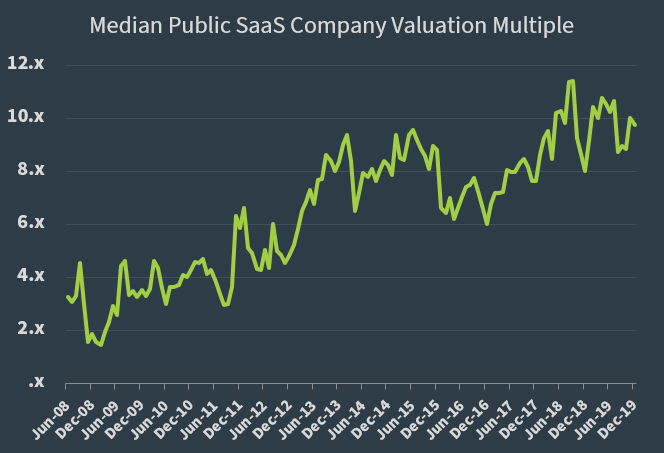

Following the methodology laid out in our white paper on how to value a private SaaS company, you can roughly determine the value of your company at any time using a public SaaS company comp. That’s great for assessing term sheets as you negotiate a fundraising or sale. However, you can also use it well in advance of those events to better inform you of when to raise money or sell the business. Or perhaps more importantly, when not to.

What I mean by this is that if your company is predictably adding and retaining customers (and more importantly the associated revenue), you can fairly accurately calculate exactly how much more your company will be worth by waiting “x” number of months to raise or sell.

At the end of December, the SaaS Capital Index was 9.8x ARR. Applying the 2.5x public-to-private discount described in our white paper, we know that a private SaaS company is worth about 7.3x ARR on average.

Now, if your SaaS company is reliably adding $10,000 of MRR every month (net of churn), that’s $120,000 in ARR added every month, which is $870,911 in enterprise value. EVERY MONTH.

Even if you’re adding $5,000 in MRR every month, that’s still close to $500k in enterprise value gained per month. If your company adds $25,000 in MRR every month, it is adding over $2 million in enterprise value each month.

So, when should you sell your company? If you are consistently adding revenue, you should wait for as long as is feasible.

What are other situations to consider?

- If you are not growing, then you are not adding any additional value each month and likely falling behind competitors, so you should sell as quickly as possible.

- If you have not yet reached a positive economic model (i.e., CAC is greater than LTV), then you should sell as soon as possible, as every month of spending is actually eroded value.

- If your churn is so high that you are barely replacing revenue with new bookings, then high churn will eventually erode value.

- If you know something is looming on the horizon that could impact your value (i.e., a competitor feature launch or a large customer is going to churn), then you may want to sell earlier.

- There may be non-economic reasons to choose to sell “early,” i.e., a life event like buying a house, or retiring, or just ready to move on to a new opportunity.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe