How Much Runway do Private B2B SaaS Companies Have?

February 11, 2021

In our 9th annual survey* of private B2B SaaS companies, we asked participants questions to explore the overall topic of capital efficiency. This is the second of a four-part series examining the data and focuses on how much runway private SaaS companies have.

How Much Runway do SaaS Companies Have?

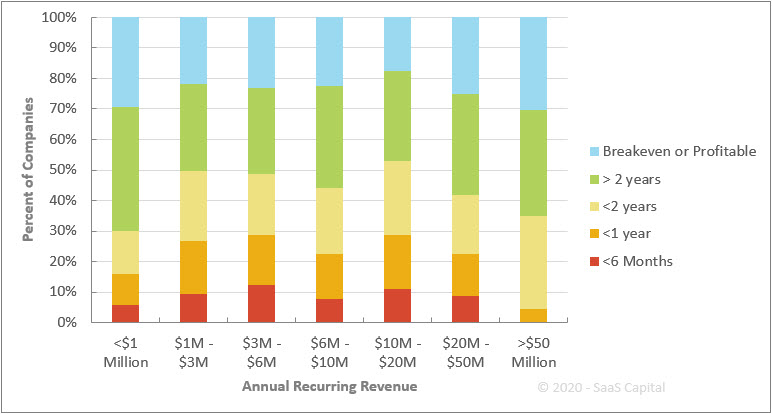

Looking at companies that have raised equity, the following chart shows that 50% are either profitable, breakeven, or have runway for at least 2 years. Another 25% of companies have less than 1 year of runway. Only a small number, less than 10%, have less than six month’s runway.

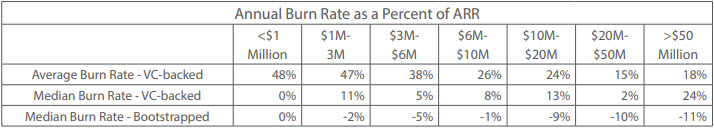

Below is a summary table of burn rates as a percent of revenue for equity-funded companies compared to bootstrapped companies, sorted by ARR. The negative numbers indicate profitability of those percentages of revenue.

A reminder that this survey data was collected in Q1 2020 and was asking performance data for 2019, before any impact from the COVID-19 pandemic. We will again be completing our survey in early 2021 and will update all of the data and research to understand how SaaS companies were impacted and adjusted to the economic fallout of the pandemic shutdowns.

For more research around capital formation and the capital efficiency of SaaS companies, please see – Private SaaS Company Funding, Runway, and Capital Efficiency Benchmarking

*In the first quarter of each year, SaaS Capital conducts a survey of B2B SaaS company metrics. This year’s study marked our 9th annual survey, and, with over 1,400 private B2B SaaS companies responding this year, it is the largest survey of its kind and continues to grow every year. This year, for the first time, we asked several questions on funding sources and amounts and cash balances to study capital efficiency and runway among private SaaS companies.

It also needs to be explicitly stated that this data was collected in early 2020 and is based on 2019 performance metrics and data, before the impact of the COVID-19 pandemic. Benchmarking comparisons should be made to the same time period for your company.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe