Private SaaS Company Valuations: Q1 2020 Update

April 10, 2020

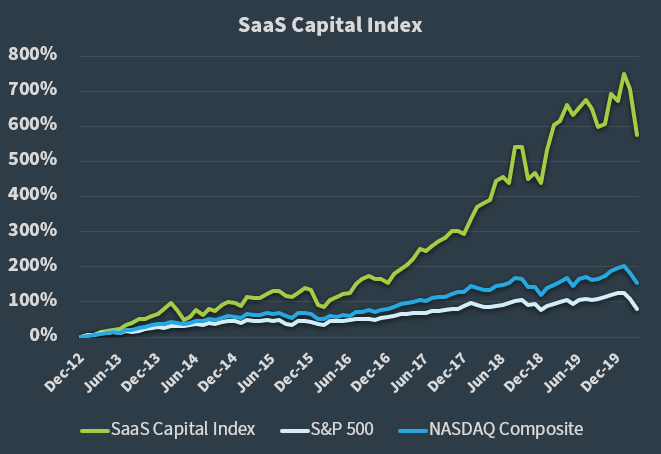

We created the SaaS Capital Index (SCI) as a resource for the owners and operators of software-as-a-service (SaaS) businesses to use as part of a valuation framework for private SaaS companies. With the recent market swings at the end of Q1, it is an opportune time to check in on the SCI.

SaaS Capital Index Background

As explained in the framework, public SaaS company data is the best starting point when valuing a private SaaS business because:

“Public market valuations reflect real-time information and have high data integrity because they include many different companies and are based on audited financial statements.”

We wanted to build our own index that most directly compared to the types of companies we work with: pure B2B SaaS companies. While there are several public SaaS indices available, we felt that none had the focus we were striving for. In addition to excluding SaaS companies principally serving B2C customers, the SCI excludes very-low ACV companies; while they may be B2B, very low ACV products have more similar characteristics to B2C products.

The final major differentiating factor for the SCI is that the revenue multiple is based on annualized current run-rate revenue, not trailing or projected revenue like other indices use. We believe run-rate revenue is the most accurate and objective measure of the current scale of the business and, therefore, the best measure to be used for valuation purposes.

SaaS Capital Index Performance vs. the Broad Market

In February, the NASDAQ Composite and S&P 500 lost 6.4% and 8.4%, respectively, while the SCI showed relative outperformance with a 5% loss that month. The market volatility caught up with SCI in March as it dropped 16%, compared to a drop of about 10% for the NASDAQ Composite. Year-to-date, the SCI is down 12%, slightly outperforming the NASDAQ Composite.

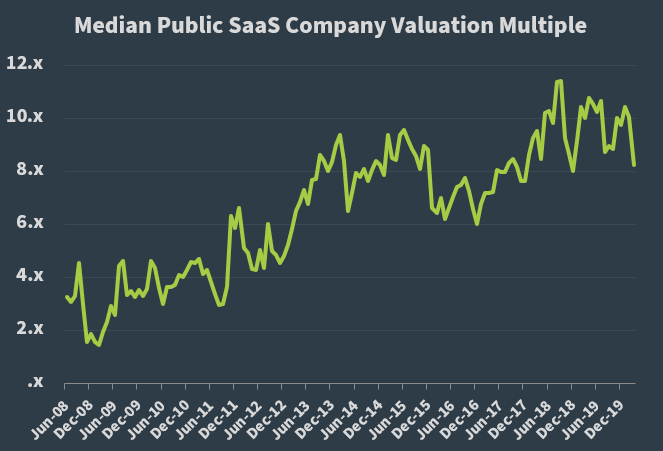

Median Public SaaS Company Valuation Multiples

When the SCI was created last October, the public revenue multiple stood at 9 times run-rate revenue. Applying the historical private company discount of 28% yielded a multiple of 6.5 for an average private SaaS company.

In December, we provided an update to SaaS Capital members which noted that while the NASDAQ Composite was hitting all-time highs, multiples stood about where they had been 18 months ago at 9.8 times annual recurring revenue (ARR). The implication was that revenue growth was driving up valuations, not multiple expansions. (You can sign up for future updates via the “subscribe” box on the right-hand side of this page.)

Today, the median public SaaS company valuation multiple stands at 8.2 times ARR. This leaves the multiple near the lower end of the range in place for the last two years but well above the levels seen a decade ago. Even in a historic economic crisis, SaaS valuations remain strong by historical standards.

Summary

When we published What’s Your SaaS Company Worth?, the intent was for the SaaS Capital Index to be a starting point for a comprehensive valuation analysis.

Based on the current public multiple, the average private SaaS would be valued at 5.9 times ARR.

However, as outlined in that white paper, there are company-specific value drivers that every operator should consider as they prepare for an equity raise or sale of their company. Listed in order of importance, they are:

- Growth & Scale of Revenue

- Market Size

- Revenue Retention

- Gross Margin & Revenue Mix

- Customer Acquisition Efficiency & Unit Economics

- Profitability

And, as I discussed earlier this year, there are additional considerations that determine when it is optimal to raise money or sell your business. The current market conditions due to the COVID-19 pandemic likely would depress valuations, but the enormous pile of VC and PE dry powder is still looking for good investments. Just this week, we received two inbound PE phone calls wanting to acquire a couple of our higher-performing companies. If your company is stable and not impacted by the pandemic, or even benefitting from it, you should be able to justify the market multiple and confidently rebuff a discount due to the current market conditions.

Our Approach

Who Is SaaS Capital?

SaaS Capital® is the leading provider of long-term Credit Facilities to SaaS companies.

Read MoreSubscribe